Our Thoughts on Liberty Mutual Pet Insurance

Liberty Mutual earned 4.3 out of 5 stars in our industry-wide review of the best pet insurance providers on the market. It earned the highest possible marks for plans and eligible age limit, plus multiple bonus points for our covered treatments rating category. Note that Liberty Mutual pet insurance is available in all 50 U.S. states.

Liberty Mutual’s strengths as a pet insurance provider lie within its covered treatments. The company offers treatment for behavioral issues, congenital and hereditary conditions, dental work related to accidents, prescription medications and more as standard coverage within its policies. Based on our research, many providers offer this sort of coverage as an add-on for an additional monthly cost, making Liberty Mutual stand out amongst its competitors.

While Liberty Mutual has many strengths, it lost significant points for low customer review ratings through the Better Business Bureau (BBB) and Trustpilot. It also lacks a 30-day money-back guarantee, mobile app, vet chat line and 24/7 customer service, resulting in a loss of points for customer experience. If you’re looking for a pet insurance policy with an extensive range of covered treatments, our team recommends Liberty Mutual.

How Liberty Mutual Scored in Our Methodology

After analyzing Liberty Mutual using our pet insurance ratings methodology, we found the provider scored 4.3 out of 5 stars. While the company scored lowest based on brand reputation and customer experience, it received the highest possible score in our plans and eligible age limit categories. Plus, it earned significant bonus points for covered treatments, boosting its overall rating.

Liberty Mutual Plans and Pricing

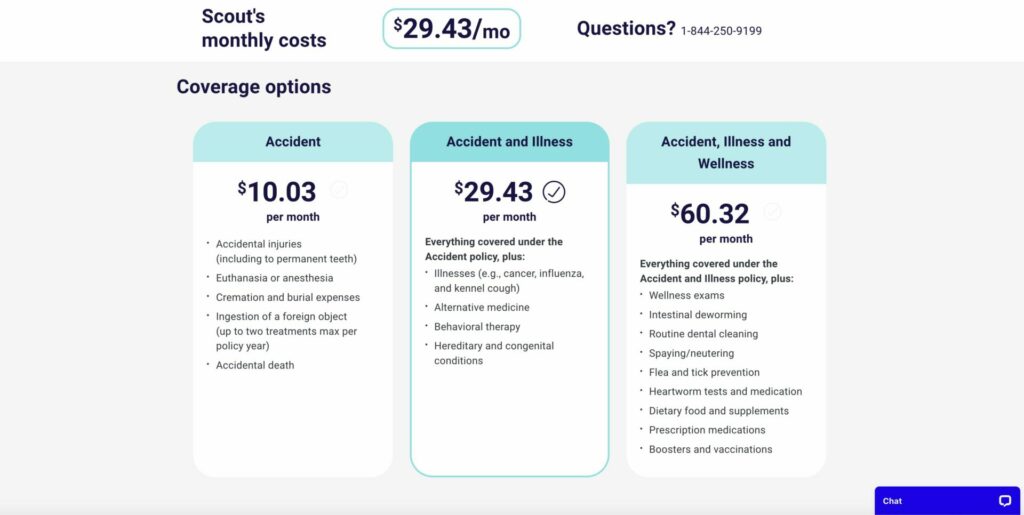

Liberty Mutual offers three plans that can cover pet-related accidents, illnesses, and wellness procedures and services. Each plan allows you to customize the annual limit, reimbursement rate and deductible. In our experience, gathering a quote for pet insurance from Liberty Mutual is relatively straightforward. You can generally expect to answer several questions about you and your pet before Liberty Mutual offers you quotes and detailed plan information.

How Much Does Liberty Mutual Pet Insurance Cost?

The cost of a Liberty Mutual pet insurance policy depends on your chosen coverage level, deductible, yearly limit and reimbursement rate, as well as your pet’s breed, size, health history and more. To gain a better picture of the cost of a Liberty Mutual plan, we gathered quotes using the following sample pet profiles for each of this provider’s policies:

- A 5-year-old medium, mixed-breed male dog

- A 2-year-old large, golden retriever female dog

- A 5-year-old mixed-breed male cat

- A 2-year-old Siamese female cat

Based on these profiles, we found the average cost of a Liberty Mutual pet insurance plan is $44 per month — which is 11% less than the average cost of pet insurance based on quotes gathered from 14 different providers. Breaking down Liberty Mutual’s costs even further, it costs around $56 per month to insure a dog and $32 for a cat.

More specifically, our team determined the average cost of each plan by requesting quotes for a policy with a $10,000 annual limit, $500 deductible and 80% reimbursement rate.

| Plan | Accident-Only | Accident and Illness | Accident, Illness and Wellness |

| Average cost | $16 | $42 | $74 |

| Summary | A base-level plan that covers accidents only, including injuries, accidental death, foreign body ingestion and more. | This plan covers both accidents and illnesses, offering reimbursement for alternative treatments, behavioral therapy, and hereditary and congenital conditions. | The company’s highest level of pet insurance coverage, which provides accident and illness coverage in addition to wellness exams, routine dental cleanings, prescription medications, vaccinations and more. |

Liberty Mutual pet insurance costs around $44 per month, based on quotes we gathered for four sample pets nationwide. The company earned 4.5 out of 5 stars in the cost section of our review methodology. The average score across all 32 providers we’ve rated is 4.3 out of 5 stars, ranking Liberty Mutual as above average in this category.

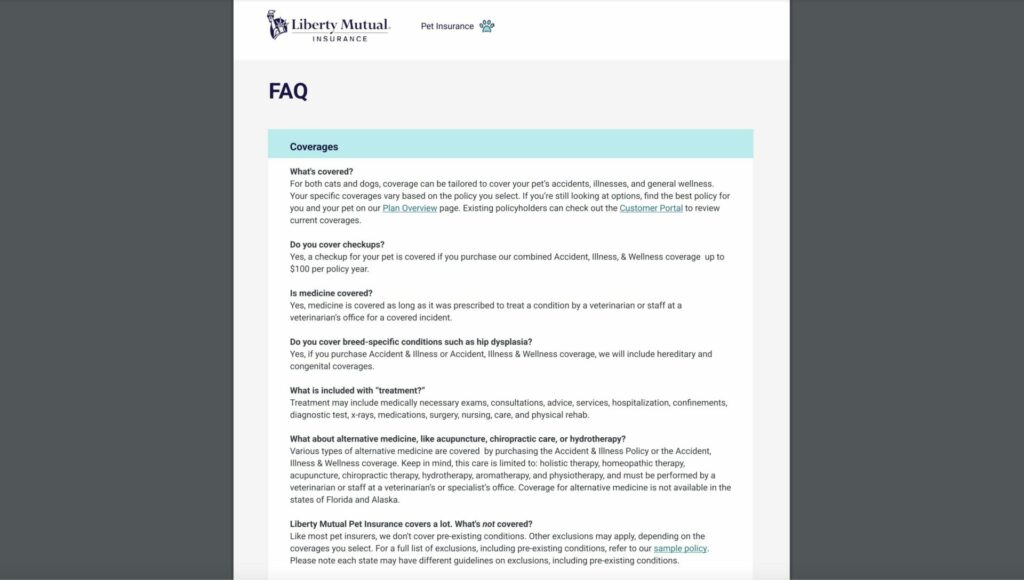

What Does Liberty Mutual Pet Insurance Cover?

Liberty Mutual offers three types of pet insurance plans. Its base plan is the least expensive option and covers accidents only, whereas the accident and illness plan covers veterinary services if your pet gets hurt or becomes sick.

While we’ve found that many providers offer wellness coverage as an add-on, Liberty Mutual combines this coverage with accident and illness protection to create a third plan. This policy includes accident and illness coverage plus routine care services such as physical examinations, spay and neuter procedures, prescription medications and more.

Liberty Mutual Preventative Care Plans

Liberty Mutual bundles wellness care with accident and illness coverage to create its most comprehensive coverage plan. However, unlike with other insurers, you cannot purchase preventative care and wellness protection separately or as an add-on with any other plan. If you’re looking for a preventative care plan that functions as an add-on, consider another provider, such as Lemonade or ASPCA Pet Health Insurance.

Liberty Mutual Optional Add-On Coverage

Our research found that Liberty Mutual offers no optional add-on coverages that you can purchase with a pet insurance policy. While many other providers offer add-ons for vet exam fee coverages and prescription medications, Liberty Mutual includes coverage for these items under its Accident, Illness and Wellness plan.

Customizable Coverage Levels

Liberty Mutual offers several options for policy deductibles, reimbursement rates and annual coverage limits, which you can customize to fit your budget. This insurer provides customization options for all three plans, including its accident-only plan. Based on our research, many other pet insurance companies do not offer customization options for accident-only plans.

Deductible Options

An annual pet insurance deductible is what you have to pay out of pocket before Liberty Mutual will cover your pet’s medical expenses. The lower your deductible, the higher your monthly premium cost. The higher the deductible, the more you’ll pay when it’s time to file a claim.

Liberty Mutual pet insurance policyholders can choose a deductible of $250, $500 or $1,000. However, if you purchase a pet health insurance plan that includes wellness coverage, you do not need to pay a deductible to file a preventive care claim.

Reimbursement Rates

Your reimbursement rate is the percentage of a submitted claim that Liberty Mutual will pay after you reach your deductible. Liberty Mutual offers plans with a 70%, 80% or 90% reimbursement rate. For example, if you have a $250 deductible and an 80% reimbursement rate, Liberty Mutual will cover 80% of your submitted vet bills after you pay the $250 deductible.

Annual Limit Options

Your annual limit is the maximum dollar amount that Liberty Mutual will reimburse you each year for covered claims. Liberty Mutual’s annual limit options are $5,000, $10,000 or $15,000 — this provider has no unlimited option. As with other insurance products, a higher yearly limit will likely increase your monthly premium.

Sign-Up, Claims Filing and Payout Processes

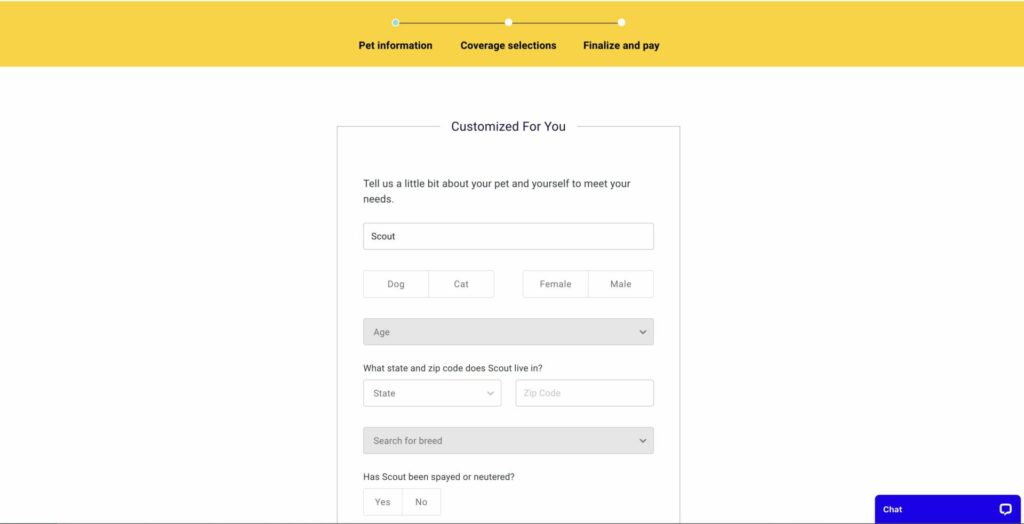

To provide a first-person review of Liberty Mutual’s pet insurance sign-up process, we tested its web portal by gathering quotes and going through the process ourselves. First, you’ll provide your pet’s name, species, sex, age and breed. The company will also ask whether your pet has been spayed or neutered and if it has had a comprehensive physical examination by a veterinarian within the past 12 months. From there, you must provide more personal information, such as your name, email and phone number.

Once you’ve submitted the necessary information, the site will direct you to a portal where you can choose from Liberty Mutual’s three plan types — accident-only, accident and illness, or accident, illness and wellness coverage. You can also customize the annual coverage limit, deductible, reimbursement rate and billing schedule to best suit your budget and coverage preferences.

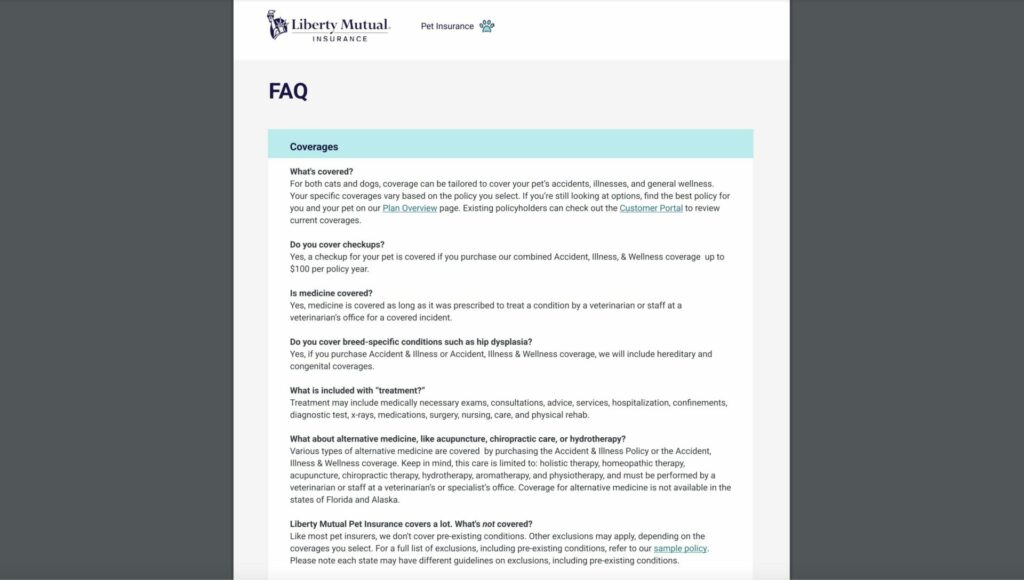

While Liberty Mutual provides customers with a short list of exclusions as they shop, you’ll need to review your pet’s policy to see a complete for your chosen plan. In our experience, it was difficult to locate a sample contract. We had to browse through the provider’s frequently asked questions (FAQ) section to find any mention of a sample contract, which left us wishing it was easier to access.

Once you’ve made your selections, you can finalize your application by providing more personal information and creating a login for Liberty Mutual’s customer portal. Then, you’ll need to certify that a veterinarian has examined your pet within the last 12 months and provide the vet’s contact information. Depending on the results, the company will either approve or deny coverage.

To learn more about other policyholders’ experiences with the buying process, we analyzed customer reviews for Liberty Mutual on the BBB and Trustpilot. However, we were unable to find any reviews specifically mentioning the provider’s pet insurance offerings. Some reviewers, such as this policyholder and this customer, made a note of their dissatisfaction with how Liberty Mutual handles their claims and customer service. Despite this, your experience with the provider for a pet insurance claim may vary.

Our team reached out to Liberty Mutual for comment on its claims process and customer service but did not receive a response.

Liberty Mutual Waiting Periods and Age Restrictions

Most pet insurance companies require waiting periods before new policyholders can start the claims process. Liberty Mutual considers any pet health conditions that arise during the waiting period as pre-existing, and it will not cover treatment. Liberty Mutual extends a 14-day waiting period across all its plans, including accidents, illnesses and preventative care. Comparatively, most pet insurance providers require shorter or no waiting periods for accident coverage.

As for age restrictions, there are no upper age limits that restrict a pet from Liberty Mutual coverage. This means you can apply for coverage for your senior dog or cat regardless of its age.

What Customers Think About Liberty Mutual Pet Insurance

To rate a pet insurance provider on its customer service, our research team reads through customer reviews on platforms such as the BBB and Trustpilot. At the time of writing, Liberty Mutual holds a 1.1 out of 5-star rating on Trustpilot and a 1.1 out of 5-star rating with the BBB.

During our research, we were unable to find any reviews on either platform that specifically mention Liberty Mutual’s pet insurance plans. However, the provider’s low scores for its other policy offerings — which include auto, home and renters insurance policies — may offer some insights into the company’s customer service and processes as a whole.

Our team reached out to Liberty Mutual for comment on its customer reviews but did not receive a response.

Liberty Mutual Pet Insurance vs. the Market

The table below compares coverage, costs and more between Liberty Mutual and other top-scoring providers that our team has reviewed.

Liberty Mutual vs. Lemonade

Liberty Mutual and Lemonade offer the same reimbursement rates for their plans, but the similarities end there. Lemonade offers higher annual limits and costs almost half of what a Liberty Mutual plan does, based on quotes gathered by our research team. Both providers also offer three choices of deductibles, although the available amounts differ.

| Liberty Mutual | Lemonade | |

| Reimbursements | 70%, 80% or 90% | 70%, 80% or 90% |

| Deductibles | $250–$1,000 per year | $100–$500 per year |

| Annual limits | $5,000–$15,000 | $5,000–$100,000 |

| Average cost for dogs | $56 per month | $30 per month |

| Average cost for cats | $32 per month | $16 per month |

Read our Lemonade Pet Insurance Review to learn more.

Liberty Mutual vs. Spot

Both Liberty Mutual and Spot offer similar reimbursement rates and deductible ranges. However, Spot provides more options, allowing you to choose from five deductibles, while Liberty Mutual only has three. Additionally, Spot offers an unlimited annual limit option, which Liberty Mutual lacks. It’s also worth noting that Liberty Mutual is, on average, 32% less expensive for dogs. For cats, both providers have similar average costs based on our quotes.

| Liberty Mutual | Spot | |

| Reimbursements | 70%, 80% or 90% | 70%, 80% or 90% |

| Deductibles | $250–$1,000 per year | $100–$1,000 per year |

| Annual limits | $5,000–$15,000 | $2,500–unlimited |

| Average cost for dogs | $56 per month | $74 per month |

| Average cost for cats | $32 per month | $33 per month |

Learn more by reading our Spot Pet Insurance Review.

Frequently Asked Questions about Liberty Mutual Pet Insurance

Liberty Mutual has no upper age limit for cats and dogs, meaning it should not deny enrollment once your pet hits a certain age. The company sells policies to cover pets starting at 8 weeks or older. If you have a senior pet, you can apply for coverage no matter its age.

Whether a Liberty Mutual pet insurance policy is worth it is a personal decision. However, it’s best practice to consider each company’s coverage options, cost and customer reviews when deciding on pet insurance. You may find pet insurance worth the investment if you want coverage for your pet in an emergency. In addition, current Liberty Mutual customers can take advantage of multi-policy discounts to lower pet insurance costs.

The cost of a Liberty Mutual pet insurance policy will vary based on your pet’s age, breed, size and more, in addition to your chosen coverage level. Based on quotes we gathered using four unique pet profiles, the average cost of a plan from this provider is $56 per month for dogs and $32 for cats.

Liberty Mutual has a 14-day waiting period across all its plans. This includes accidents, illnesses and orthopedic conditions. If any health condition arises during your waiting period, Liberty Mutual will consider it pre-existing and won’t cover treatment.

Methodology: Our System for Ranking Pet Insurance Companies

Credt: Source link